Healthcare and Life Sciences M&A Outlook

-

July 01, 2024

-

Muted activity in the private equity (“PE”) deal environment in the first and second quarters of 2024 continues to reflect ongoing challenges in the market. Rosy projections voiced at the McDermott Will & Emery HPE Conference have yet to materialize, as evidenced by the modest decline in deal volume announced in May 2024.1

Private Equity Consulting Learn more

However, this trend is likely to change as we progress through 2024, driven by PE deal pipelines with strategic targets, sector-specific opportunities, and a focus on value creation. Smaller and less-frequent deals with longer conversation timelines will continue to represent most of the deal activity.2 There may be reduced interest in private equity investments in healthcare provider services, attributable to shrinking margins, continued operational challenges due to the No Surprises Act (“NSA”) and recent announced changes to CMS’s reimbursement policies.3

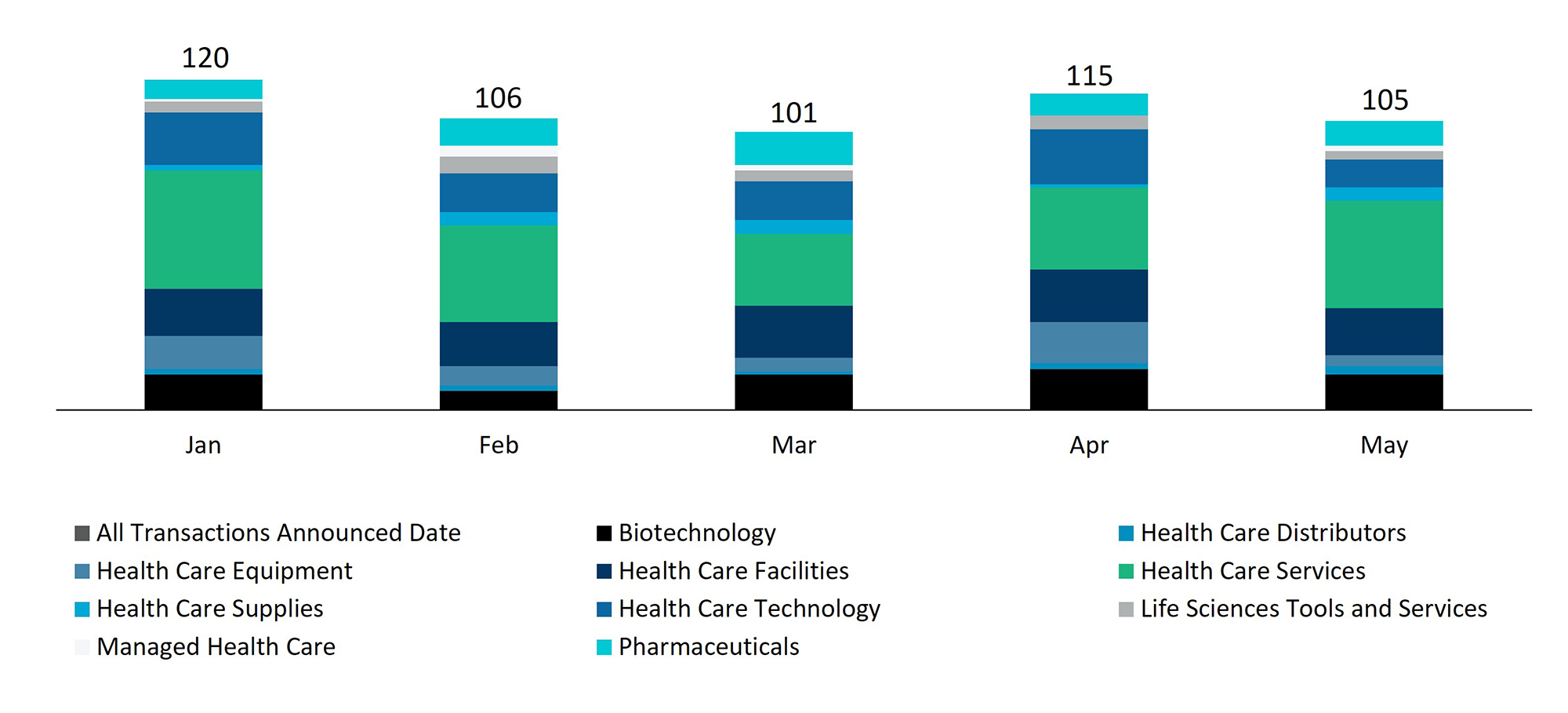

An analysis of healthcare M&A trends in 2024 reveals notable changes in deal volume and transaction values:

- To date in 2024, announced deal volume in healthcare has averaged 109 per month4

- May 2024 healthcare deal volume remained relatively flat compared to 1Q24, but dipped from April’s volume.5 Only March of 2024 was a slower month in healthcare M&A.6

- In addition to slower deal volume, average transaction value also sharply dropped in May, falling by 52% when compared to the monthly average of 2024.7

Announced Healthcare Transactions by Month (January 1, 2024 to Present)8

Investment Insights for Healthcare and Life Sciences in 2024

- As provider organizations continue to struggle with integration, scale and cost, solutions that address these challenges will remain attractive investment targets.

- Point solution, automation tools and IT infrastructure will continue to be attractive as organizations struggle to manage cost and scale.

- Physician practice management (“PPM”) deals will continue to be slow to materialize, as a mismatch exists between valuation expectations and market demand.

As healthcare providers navigate integration, scale, and cost management issues, innovative solutions and targeted investments will likely drive future deal activity in this evolving sector.

SPOTLIGHT: Unlocking $20M+ in EBITDA Opportunities for Dental Services Organization

FTI Consulting was engaged by a senior lender group to assess the financial position, liquidity and performance opportunities for a dental services organization (“DSO”) amid liquidity challenges and debt servicing issues.

Situation

The client, a DSO, has undertaken significant growth by nearly tripling the number of locations and doubling the number of practices since 2021. However, this rapid expansion through mergers and acquisitions in an inflammatory environment has placed added strain on the company’s cash flow, liquidity and operational efficiency. In response to these challenges, the company has enlisted the expertise of strategic consultants and investment banks to help manage its growth and raise additional capital.

Our Role

FTI Consulting evaluated the feasibility and efficacy of existing improvement plans and de novo analyses, including the likelihood of achieving substantial positive EBITDA. We analyzed the client’s initiatives to identify opportunities for improved financial and operational performance.

Our team reviewed client data, held on-site and virtual interviews with stakeholders, and presented findings and recommendations to leadership. The assessment consisted of three workstreams:

- Financial Forecast, Liquidity Management & Working Capital

- Central Business Function

- Clinic Network

Our Impact

FTI Consulting identified approximately $20 million in EBITDA improvement opportunities related to central business function activities, including write-off reduction and uncompensated care ratio (“UCR”) increase initiatives.

- We identified drivers of negative financial performance and conducted multi-scenario sensitivity analyses to estimate the client’s liquidity needs.

- Our team identified additional clinic network EBITDA opportunities of approximately $4 million with changes to the staffing model and office consolidations.

- We developed a prioritized list of short- and long-term recommendations and estimated cash impacts based on identified areas of opportunity within each workstream.

Footnotes:

1: 1. Rebecca Springer, “Takeaways From the 2024 McDermott Will & Emery HPE Conference,” Pitchbook, 19 March 2024

2: Ibid

3: 3. Rebecca Springer, “Q4 2023 Healthcare Services Public Comp Sheet and Valuation Guide,” Pitchbook, 5 April 2024

4: “S&P Capital IQ,” FTI analysis, Capital IQ, 01 June, 2024.

5: Ibid

6: Ibid

7: Ibid

8: Ibid

Published

July 01, 2024

Key Contacts

Key Contacts

Senior Managing Director, Leader of Commercial Due Diligence

Managing Director

Senior Director

Senior Consultant